Program Overview

A proprietary data intelligence platform developed to aid in the recovery of uncompensated motor vehicle accident (MVA) care claims.

At MVA reCOUP, we use data intelligence tools and an in-house database with over 100 million pertinent records such as citations, related parties and insurance coverages – to recover payments from MVA related charges.

By identifying the obligated payor (which isn’t necessarily the at-fault party) and evaluating available coverages at time of incident, we are able to increase third-party liability recoveries.

There is still value in your older write-offs and charity care… let us identify and collect on your behalf, or better yet, we will pay you up front for the right to collect on your behalf.

The Difference

Our automated approach to handling high volumes of accounts allows us to analyze ALL charges regardless of classification code or department.

This helps us to not only recover low-dollar claims that others have missed, but we find MVA related treatments that may not have been identified during billing. Additionally, we match treatment you provided to pedestrians and passengers, thus increasing our recoveries and your profitability.

What sets us apart:

- We collect only on closed files, 1 to 5 years old.

- We use proprietary data tools to predict recovery success prior to contacting payor.

- We recover the toughest, oldest claims, especially low balance.

- We cover all costs – we’re compensated only if we collect.

- We make it fast and hassle-free for your IT department.

- We see results – usually in 90 days or less.

Here’s what we DON’T do:

- We don’t contact your patients, EVER.

- We don’t replace existing partners or relationships.

- We don’t disrupt or infringe upon current collection practices.

- We don’t need your team to create demand packages or to contact carriers.

- We don’t waste your time or money.

Up Front payment to your organization.

Need a cash infusion before year or quarter end? We are so confident in our abilities to recover on your aged debt that we offer immediate payment before any recoveries are made with no claw-back provisions. Let us run your file, analyze the results and propose a compensation scenario that makes sense.

A “last-in-line” recovery solution.

No doubt that your organization already has a mechanism in place to capture MVA related activity. We’ve found even the most efficient providers do not get all the necessary information to effectuate a recovery in all instances, besides, knowing your patient was in an MVA is only part of the puzzle, you have to know who and how to bill. This is where MVA reCOUP shines.

Data Intelligence

Comprehensive, data-driven solutions.

We increase MVA recoveries by identifying valid coverages in effect on the admission date for applicable vehicles/persons. These policies are often issued to someone other than your patient and present an investigation nightmare. Simply put, we connect the dots for your problem accounts and work with the responsible third-party insurer to receive payment.

How we do what we do in four easy steps:

STEP 1: Data Collection

We routinely receive data updates from hundreds of government agencies and private insurers.

STEP 2: Data Normalization

We then normalize hundreds of millions of unique records into one database.

STEP 3: Data Intelligence

Using our proprietary, predictive analytics, we create custom data products.

STEP 4: Data Delivery

We share these data-driven insights with our clients, ranging from CFOs, HR executives and managers, healthcare providers, P + C carriers, traffic safety research firms, community partners and other organizations so that we can help them solve their biggest challenges.

Get Started

Minimal client involvement. No risk, no exposure – we do it all.

After providing us with your uncompensated care file, there is nothing to do but sit back and watch us collect on your behalf.

Provide us a data file with a few pertinent columns regarding your bad debt and charity and self pay care – aged debt, 1 to 5 years old, no department or treatment filters necessary – and we’ll give you an estimate. We’ll show you how many unresolved claims we feel we can recover for you and start turning those losses into revenue.

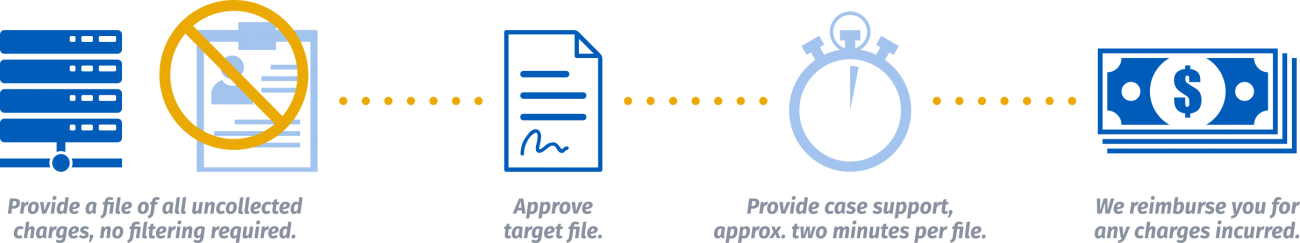

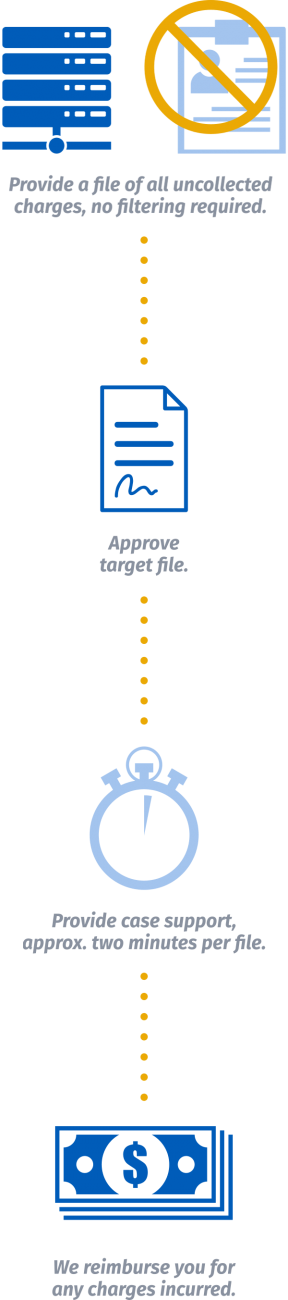

Our MVA reCOUP program is simple to activate, effortless to run. Here’s all you have to do:

- Provide a file of all uncollected charges, 1 to 5 years old. (approx. 1 to 2 hours)

- No filtering required, simply run all charges made by your system.

- Approve target file for collection. (approx. 1 hour)

- Provide limited case supports for approved target file.

- The timing on this varies, based on system access.

- We estimate it would take you approximately two minutes per file.

- We reimburse you for any charges incurred during this transfer time.

Contact Us Today

How can we help?

Phone: 866.941.6324

Fax: 704.255.6075

9525 Birkdale Crossing Drive, Suite 300

Huntersville, North Carolina 28078

"*" indicates required fields